Integrated, full-service payroll has finally arrived

Skip the manual exports and multiple third-party programs to run payroll.

Integrated Time & Payroll

Syncs with attendance data so you can approve and process payroll from one place.

Employees & Contractors

Pay your hourly and salaried employees and contractors with direct deposit.

Payroll Calculation

Taxes, benefits, deductions, and garnishments across thousands of tax jurisdictions.

Compliance, accuracy, and peace of mind.

Auto-calculations for fewer mistakes

Track lunches, breaks, and more

TreeRing Time helps you stay in compliance if you have hourly workers.

Automatic Tax-Filing

TreeRing Payroll automatically calculates your payroll taxes and files them with the IRS and other federal, state, and local agencies at the right time, every time—even when employees move locations. You never need to lift a finger.

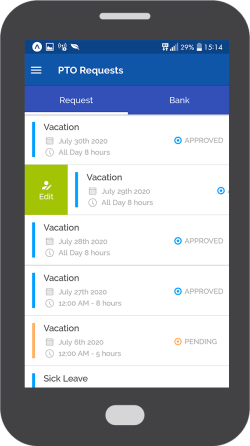

Track hourly work and PTO effortlessly using TreeRing Time

Customize your business’s PTO policy, then review and approve employees’ time off requests with a click—knowing all the while that approved working hours and PTO automatically sync with payroll.

To make the switch, you barely have to lift a finger.

TreeRing will set up payroll for you for free.

- We’ll transfer your payroll data to TreeRing Payroll for you, so the switch is completely effortless and risk-free.

- We’re a team of proud payroll nerds. And we’re here to help.

Run payroll in 90 seconds

What's included in payroll?

- 2-day direct deposit for qualified companies.

- Printable checks.

- Automated payroll tax payments & filings.

- W-2s & 1099s.

- Unlimited payroll runs.

- Employee self-onboarding.

- Online self- onboarding for W-4, I-9, W-9 & direct deposit forms.

- When your team clocks in and out in TreeRing Time, we instantly calculate hours, breaks, overtime, and PTO—and sync it all to payroll to help you avoid mistakes.

- You get to run payroll with just a few clicks. We’ll handle the tax calculations, send direct deposits, and file your taxes for you.

- Because your employees can self-onboard and e-sign their payroll forms, you don’t have to enter their tax or bank information.

Tools for your team

- Access to schedules, hours, wages, pay stubs & W-2s.

- Payday emails & direct deposit notifications.

- Online self- onboarding for W-4, I-9, W-9 & direct deposit forms.

- Time-off requests.

A complete hourly toolkit

- Employee scheduling.

- Time clocks & online timesheets.

- Paid-time-off policies & tracking.

Get payroll built for your teams.

Everything you need to pay your team is $30/month base + $5/month per person.

Integrated TreeRing Time.

Unlimited payroll runs.

W-2s and 1099s.

Automated payroll tax payments & filings.

Direct deposit & printable checks.

Employee self-onboarding.

Want to learn more about us and our Workforce solutions?

We invite you to contact us anytime!